A week ago, Secretary of State candidate Pat O’Brien released a statement pointing out that “for just the year 2009[,] [Representative Mark] Martin had charged taxpayers $56,290.00 for reimbursements in addition to his legislative salary.” O’Brien further “charged that Rep. Martin has routinely billed the taxpayers for reimbursements, per diem and mileage for attending committee meetings that he is not a member of.”

It was this latter charge that piqued my interest, and I requested documentation of Martin’s requests for reimbursement from the House of Representatives from June 2009 to June 2010. I hoped to figure out just how much money was paid to Martin for attending meetings of committees of which he was not a member by cross-referencing the reimbursements with known dates of meetings that he attended.

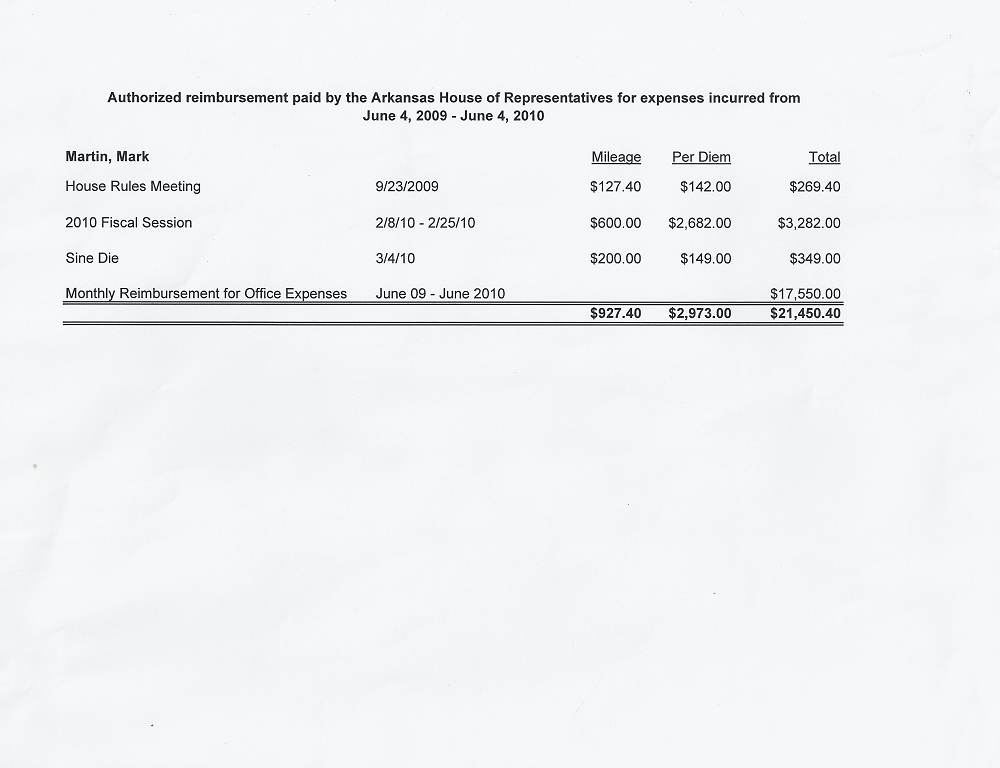

When I received the records, however, I quickly realized that the mileage reimbursement was not the most important issue. Take a gander at this summary sheet of money Martin received from the state:

(click to enlarge)

Martin actually received less than $1000 in mileage reimbursements from the House for this time period. Considering Martin lives 197 miles from the Capitol, that seems like a completely reasonable amount. So, all good, right?

C’mon. You should know me better than that by now.

You see, when I was going through the documents, I noticed something far more troubling than Martin’s mileage. Specifically, it looks to me like Martin’s reimbursements for his office expenses amount to a possible ethics violation (at minimum).

The gist of the problem is this: Martin’s business (M3 Engineering, Inc.) bills Martin in his capacity as state rep for office space in his own home, and Martin concurrently uses that office space and his office phone(s) for campaign purposes, which is a no-no. However, I don’t want to get ahead of myself or fail to cross any t’s or dot any i’s, so let me back up and take this step-by-step.

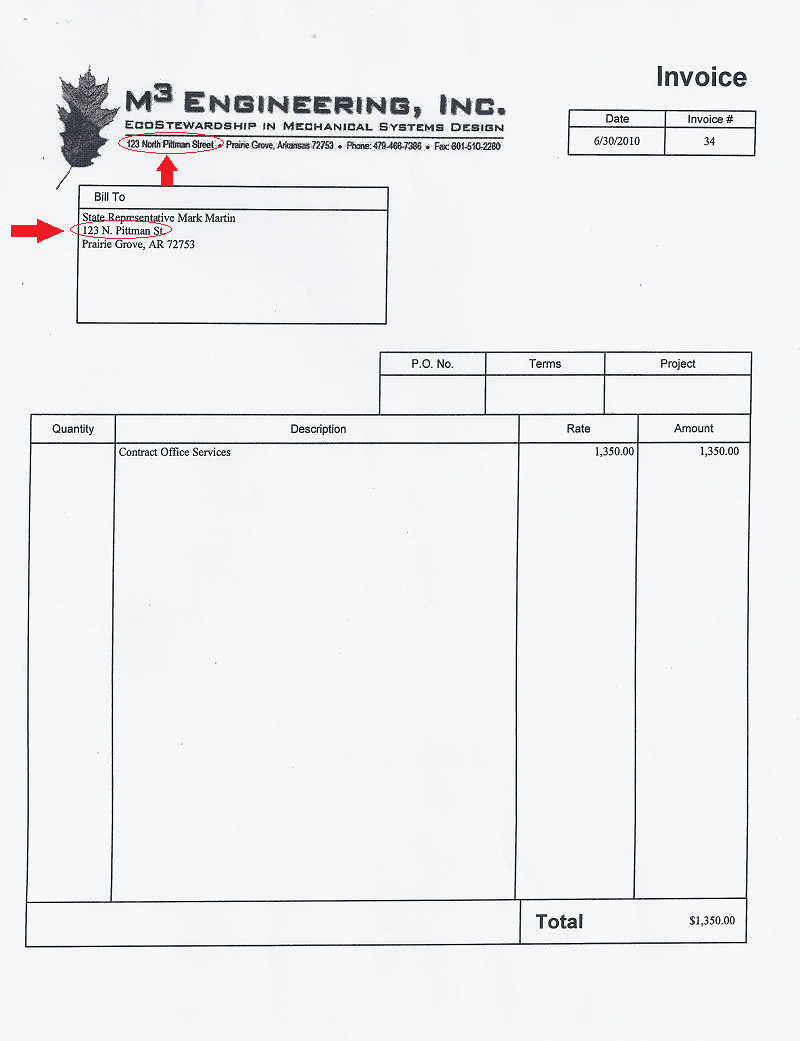

As part of the documents I requested, I received 13 invoices from M3 Engineering, Inc., billing State Representative Mark Martin $1,350.00 per month for “Contract Office Services.” To wit:

On its face, that’s not a problem. Arkansas Code Annotated § 10-2-212 states:

A member of the House of Representatives may seek reimbursement for legislative expenses incurred as authorized by law by filing a signed statement of expenses incurred during each calendar month. Claims for reimbursement for expenses incurred shall be filed with the Coordinator of House Legislative Services and shall be paid from the funds appropriated for such purposes for the use of the House of Representatives.

Ark. Code Ann. § 10-2-212 (b)(1).

Where Martin’s reimbursement starts to become an issue, however, is when you look more closely at the invoice:

M3 Engineering, Inc., is Mark Martin’s own business. More importantly, the address listed on M3‘s articles of incorporation is 123 N. Pittman St., Prairie Grove, AR. Coincidentally enough, Martin’s home address is … wait for it … 123 N. Pittman St., Prairie Grove, AR. Which is to say, Mark Martin is billing the state of Arkansas (read: taxpayers) $1,350/month to rent himself a portion of his own house.

Now, as odd as it may sound, even that action is technically ok, if somewhat irritating. After all, the reimbursement statute allows each legislator to choose from three reimbursement levels — $5820 per year, $6540 per year, or $14400 per year.1 There is nothing in the statute that explains how a lawmaker should determine which reimbursement level he or she should select, but given that we are talking about “reimbursements,” a safe guess would be that legislators should choose the level that they anticipate will best cover their expenses (office rent, phone, supplies, etc.). It might boggle the mind to figure out how Martin could possibly owe himself $1350/month for a portion of his own home, but that action in and of itself is not improper.

The problem arises, however, when you start factoring in Martin’s activities as a candidate for Secretary of State.

For one thing, not only is 123 Pittman St. listed as the business address for Martin’s company and the address of Martin’s home-county office as a legislator, but it is also the physical address of Martin’s campaign headquarters according to some sources. Look, for example, at this screen shot from Project Vote Smart:

Yes, it is completely accurate that Martin lists “P.O. Box 700” as the address at which one could contact his campaign. My guess is that he thought he would outsmart the system by having a P.O. Box, just as he thought he would outsmart the system by carefully phrasing his ridiculous intelligent design bill. It defies common sense, however, to assume that Martin has no physical office from which he does campaign-related acts — he certainly is not working out of the local post office, and his P.O. Box is therefore not dispositive of this issue.

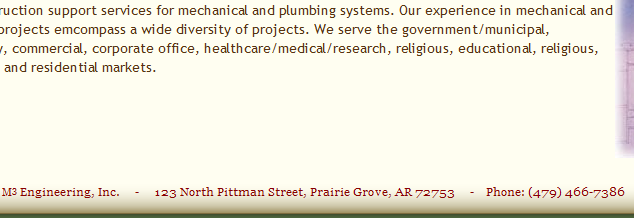

Nor is a little confusion about overlapping address use the only issue here. Consider, too, Martin’s phone. The above invoice lists M3‘s phone number as (479) 466-7386, and the company’s website says the same thing.

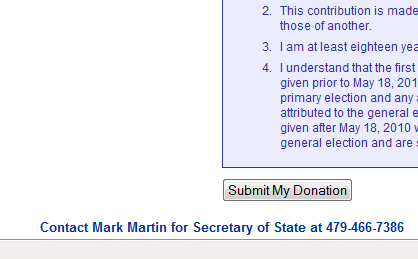

Most important, should one go to Martin’s campaign website and click the “Donate” option, that page lists the contact number for Martin’s campaign as …

The same number for contacting Martin vis-a-vis his campaign is also given at the AR GOP website.

To add to the confusion here, if you live in Martin’s area and want to sign your son up for Cub Scouts (or, more accurately, wanted to sign your son up for Cub Scouts back in 2008), you can contact Mark Martin at (479) 466-7386.

On the flipside of this little confusion fest, the House of Representatives’ website lists Martin’s contact phone number at his Prairie Grove office as (479) 846-1889.

But Project Vote Smart (graphic above), lists this number as the campaign contact phone. Notably, the Arkansas Voter’s Guide put out by the current Secretary of State Family Council also lists this number as Martin’s campaign phone.

At this point, you might be wondering why this matters. The answer is because of Arkansas Code Annotated § 7-1-103 (a)(3)(A), which reads:

It shall be unlawful for any public servant, as defined in § 21-8-402, to use any office or room furnished at public expense to distribute any letters, circulars, or other campaign materials unless such office or room is regularly used by members of the public for such purposes without regard to political affiliation. It shall further be unlawful for any public servant to use for campaign purposes any item of personal property provided with public funds.

Translation: If Martin is using his home office, for which he is reimbursed monthly by the State of Arkansas, for campaign purposes, then we’ve got a bit of an issue. Additionally, if part of Martin’s reimbursement goes pays his phone bill on one or both of the aforementioned numbers, then we’ve got a problem there, too. How much of a problem? Well, not to put too fine a point on it, but Arkansas Code Annotated § 7-1-103 (c) provides that violation of any part of that statute is a Class-A misdemeanor.

Thing is, Martin’s own greed, for lack of a more accurate word, in his selecting the highest level of reimbursement is a key factor in this being an issue. When flat-amount reimbursements are given, any amount that does not actually reimburse the legislator for expenses incurred is considered gross income. See Ark. Code Ann. § 26-51-404. Thus, even if we give Martin the benefit of the doubt and assume that he will claim that he pays only a portion of his phone bills and office expenses from his reimbursement amount and that he pays M3 (or himself directly) for campaign use of his home office, the amount of those expenses that he is paying from his own income still includes some portion of the reimbursement monies. Conversely, if Martin asserts that M3 is payed a high enough rent that the monthly checks from the state do not leave any money left over as personal income, then Martin’s use of the office as a candidate seemingly violates 7-1-103.

Had Martin simply taken the lowest amount of monthly reimbursement, which would have made sense given that there really is no rent changing hands here, any claim that he does not pay campaign expenses with leftover reimbursement money would be much more plausible. As it is, though, he is receiving $1,350 per month to rent some part of his home to himself and to cover other office expenses; short of a detailed accounting that shows the world’s most expensive cell phone bill and some serious paper use, it is illogical to assume that Martin’s working from home actually costs him $1,350 per month. At a bare minimum, even if using his company as a shell somehow insulates Martin from actual liability for this apparent double use of his home office, the underhanded nature of the whole thing should raise serious questions in voters’ minds and should raise an eyebrow or two at the Arkansas Ethics Commission.

If all of this sounds vaguely familiar, it’s because Jeremy Hutchinson leveled similar charges at Dan Greenberg during the primary season. In that situation, however, Greenberg at least nominally had an address outside his own home for which he was being reimbursed. Here, of course, we don’t even have that level of removal. Martin has simply chosen the highest level of reimbursement he could receive, used his own home-based business as an intermediary to effectively rent part of his house to himself, and then (apparently) allowed his campaign activities to take place in the same office and on the same phone lines for which the State continues to reimburse Martin.

But, hey, maybe Martin can try to find some way to spin all of this into a “Chicago-style attack” on him.

Of course, $14400/12 is $1200/month. The extra $150/month Martin receives apparently comes from an additional $1800/year he is entitled to under Arkansas Code Annotated § 10-2-205.↩