On a lark1, as I was writing the previous post about Cross County Sheriff David West’s role as landlord for Jerri Kelly, I sent a Freedom of Information Act request to Cross County for West’s campaign-finance reports. I wasn’t looking for anything in particular; I just had a gut feeling that someone who would so blatantly claim that Jerri Kelly hadn’t received preferential treatment might also be the kind of person whose campaign-finance documents might not be in tip-top shape.

When I received the records a short while ago, it took less than 5 seconds to find the first violation. In under two minutes of skimming the reports, I located no fewer than sixty violations, in only three reports, containing only fifty-four individual contributions. (Yes, some contributions had multiple violations as reported.) Of these violations, many are the kind of minor thing that the do-over provision of Ark. Code Ann. 7-6-229 make sense for, including a complete failure to include a mailing addresses on any of the thirty-five contributions in his June 2018 report as well as a failure to include the employer or place of business for several contributors.2

Other violations, however, are not so minor. Some are even inarguably criminal actions. Broadly, the more egregious violations–and the reason for this post–are as follows: two contributions over $50 where the donor is listed as “anonymous;” two contributions that fail to include more than just a single last name, without so much as a first name or a city for the contributor; and, the biggest issue, at least nine contributions from businesses, which has been illegal since November 5, 2014.

Let’s look at the relevant laws for each group of violations.

Anonymous and Incorrectly Named Contributions

How someone could think it was acceptable to show a contribution from “anonymous” defies any sort of logic that I can come up with. Arkansas law specifically has a statute section entitled “Contributions made indirectly, anonymously, or under assumed names.”3 That statute explicitly states, “No contribution shall be made to or knowingly accepted by a candidate or his or her campaign committee…unless the contribution is made in the name by which the person providing the funds for the contribution is identified for legal purposes.”

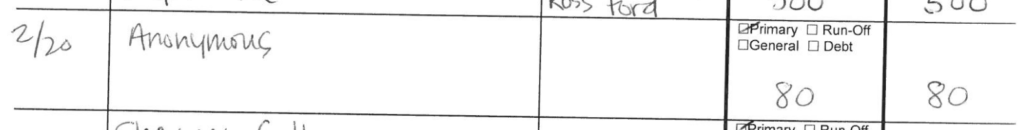

Despite this clear rule, Sheriff West’s June 2018 report includes these two entries:

That same rule requiring that a contribution be in the name that the contributor is identified for legal purposes also makes these contributions a problem:

I am assuming that these mononymous contributions were not from Jerry Seinfeld’s neighbor or the bad guy in the movie Commando. That being the case, neither contribution is sufficiently in the legal name of the person who made it, making both contributions violations similar to the anonymous ones.

Speaking of the anonymous contributions again, there is an additional wrinkle. Namely, if a candidate does receive an anonymous contribution, they aren’t allowed to keep it; the statute continues, “An anonymous contribution of fifty dollars ($50.00) or more shall not be kept by the intended recipient but shall be promptly paid by the recipient to the Secretary of State for deposit into the State Treasury as general revenues.” Neither of West’s filings subsequent to the June 2018 show a payment, immediate or otherwise, from West’s campaign to the Secretary of State’s office.

So West arguably violated Ark. Code Ann. 7-6-205 in two different ways (four contributions that weren’t in the legal name of the contributor and two failures to send anonymous money to the Secretary of State), for a total of six violations on those four contributions alone.4 A person who knowingly violates that statute is guilty of a class A misdemeanor under Ark. Code Ann. 7-6-202.

Contributions from Businesses

The violations listed above, however, are less concerning than the eleven contributions that West admittedly received from business entities.

You see, in November 2014, the people of Arkansas passed an initiated act that amended the state constitution and limited who may donate to a candidate to the following: an individual; a political party that meets the definition of a political party under § 7-1-101; a political party that meets the requirements of § 7-7-205; a county political party committee; a legislative caucus committee; or an approved political action committee.5 That’s it. The statute then specifically states, “It shall be unlawful for a candidate for a public office or for any person acting on the candidate’s behalf to accept a campaign contribution from a prospective contributor other than those” listed above.”

What you don’t see in that list of allowable contributors, of course, is contributions from business entities. They simply are not allowed at all since November 5, 2014, when the initiated act took effect. Most candidates and businesses know this, which is in part why you’ve seen a rise in PAC contributions since that date. Nevertheless, West’s reports show the following:

That is fifteen contributions that appear to come from businesses. For purposes of this post, we could be somewhat generous and give the benefit of the doubt that the entries that also list someone’s name were from the listed person, not the business. That takes care of six of the entries.6 We are still left with nine entries that are unquestionably from businesses.

Here’s where it gets extra sticky for West. All of his reports are signed, as you would expect, by David West, and are notarized as being true and correct. Which means West has explicitly stated that these contributions from businesses are correctly reported. Under article 19, section 28 of the Arkansas Constitution (as amended by the 2014 initiated act), anyone who knowingly violates the statute prohibiting contributions from businesses is guilty of a class A misdemeanor.

By reporting those contributions correctly, West has also made it so that the do-over provisions of Ark. Code Ann. 7-6-229 are inapplicable. As we have noted in the past, that provision only applies to “unintentional errors in the report.” Here, the contributions were reported correctly — the name of the contributor, the amount contributed, etc., were all entered into the report correctly.

By its own terms, however, the rule under 7-6-223 only provides an affirmative defense when someone amends a report to correct an unintentional error in the report. It says nothing about accepting an illegal contribution then simply returning the contribution within 30 days if and when someone notices it. Any other interpretation would render the rules applicable to campaign fundraising moot, as a candidate could accept all manner of illegal contributions, report them correctly, and then have thirty days to simply return those contributions if and when someone noticed the illegality. Such an interpretation would be absurd.

In short, Cross County Sheriff David West’s campaign-finance reports include myriad violations of the law, both big and small. At least nine of those violations, however, are actions that he has sworn to and cannot take back by now amending a report or returning a contribution. Because the statute of limitations for misdemeanors is only one year, it is possible that some of the illegal contributions are now time-barred, but at least three of those (and arguably many more) are class A misdemeanors for which West could (and should) be charged, just like any other political candidate would be.

Stated differently, if Sheriff West were presented with a person who had admitted to at least three misdemeanors, with other criminality obvious on the face of the actions, would he turn a blind eye?

On a whim…I said there’s two types of men in this world, and you’re neither of them…↩

Don’t get me wrong; these are all still violations of the law and will be part of the forthcoming ethics complaint. They are just minor and correctable, such that the Ethics Commission won’t have much to do with them.↩

Ark. Code Ann. 7-6-205↩

Or, more accurately, fourteen violations on those four contributions, as they also fail to include addresses or places of business, as required.↩

This is codified at Ark. Code Ann. 7-6-203(a)(1)(A).↩

It’s also quite dubious as assumptions go, since the only reason you would list someone as “Daniel O. Humphrey DBA Arbor Tech Tree Service” would be if that was the name on the check you received, which would make that a check from the business in most instances.↩