Take a trip with me, friends, back to the halcyon days of September 2021. We were so young and naive then, blithely dying from the Delta variant and knowing nothing of Omicron, riding the high of a 4-0 college football start and wholly unaware of the future beating Georgia would put on the boys. Those were the salad days.

If you reside in central Arkansas, you may also recall that there was a special election for a one-cent sales tax increase in mid-September 2021, which was being pushed hard by Mayor Frank Scott Jr. as part of his Rebuild The Rock (“RTR”) plan and opposed almost as strenuously by a group called Responsible Taxation for Little Rock (“RTLR”). After the proposed tax failed rather spectacularly at the polls, we took a look at the financial disclosures filed by both groups and found…well…let’s go with “hot garbage” as the descriptor.

It was bad enough that I filed complaints regarding both groups with the Arkansas Ethics Commission, which opened investigations into each of them.

Fast forward to this week, some seven months later. I had more or less forgotten about those complaints when, lo and behold, two letters arrived from the Ethics Commission. It seems that the Commission found probable cause to believe that both RTR and RTLR had violated certain financial-disclosure rules related to Legislative Question Committees (“LQC”) under Arkansas law. Rather than have a public hearing on these violations, our friends at RTR and RTLR signed settlement offers, acknowledging the violations.

In the case of Rebuild the Rock, the accepted settlement offer imposed a $500 fine and a public letter of caution. You can see the letter regarding the RTR settlement here:

And you can see the actual Letter of Caution here:

In the case of Responsible Taxation for Little Rock, the settlement agreement imposed a $100 fine and a public letter of caution. Here is that letter regarding the settlement:

And here is the Letter of Caution that they received:

There are a few things that jump out at me about both of these settlements. First and foremost, while they appear to be just another example of how toothless the Ethics Commission is, I think it is more accurate that they are examples of how toothless the Commission chooses to be.

What I mean is, under the current laws, the Ethics Commission is empowered to impose fines of $50 to $2,000 per violation of the campaign-reporting rules. In the Rebuild the Rock complaint, the Commission was presented with over five dozen apparent violations. They fined RTR a whopping $500. The RTLR complaint listed over 20 potential violations; they were fined $100.

Rebuild the Rock raised $346,150 to support the proposed sales tax–more on that total in a minute, because hoo boy–and turned in some of the worst attempts at campaign-finance reporting that I have ever seen. In what world is a $500 fine (0.1% of their finances) remotely enough to serve as a deterrent or a punishment in that situation?

Similarly, Responsible Taxation for Little Rock raised $70,280 in their efforts to defeat the tax, and they also turned in woefully inadequate reports. What does a $100 fine accomplish? (Hint: It rhymes with “shmothing.”)

“But wait,” you might say if you are the kind of person who feels the need to carry water for the Ethics Commission, “they also got a Letter of Caution!” To which I would say, “so what?” After all, Rebuild the Rock has officially dissolved its LQC. RTLR has had no activity to speak of since the election. So, yes, they’ve been cautioned, but cautioning an entity that is not a going concern strikes me less than effective.

Point being, imagine you are starting a new LQC tomorrow for some local issue that really gets your knickers in a twist. What incentive do you have to make sure you report the money in and money out of that LQC accurately and in a timely manner if the worst-case scenario for you is a fine that amounts to barely more than a rounding error and a letter that says “don’t do that again”? Combine this complete lack of actual consequences with the fact that the Ethics Commission takes seven months to finish the process and you’ve basically created a situation where no one has any reason to really worry about what the rules say. That is not how these things are supposed to work. But it is how the will continue to work as long as the Ethics Commission is not willing to actually exercise the powers it has been given.

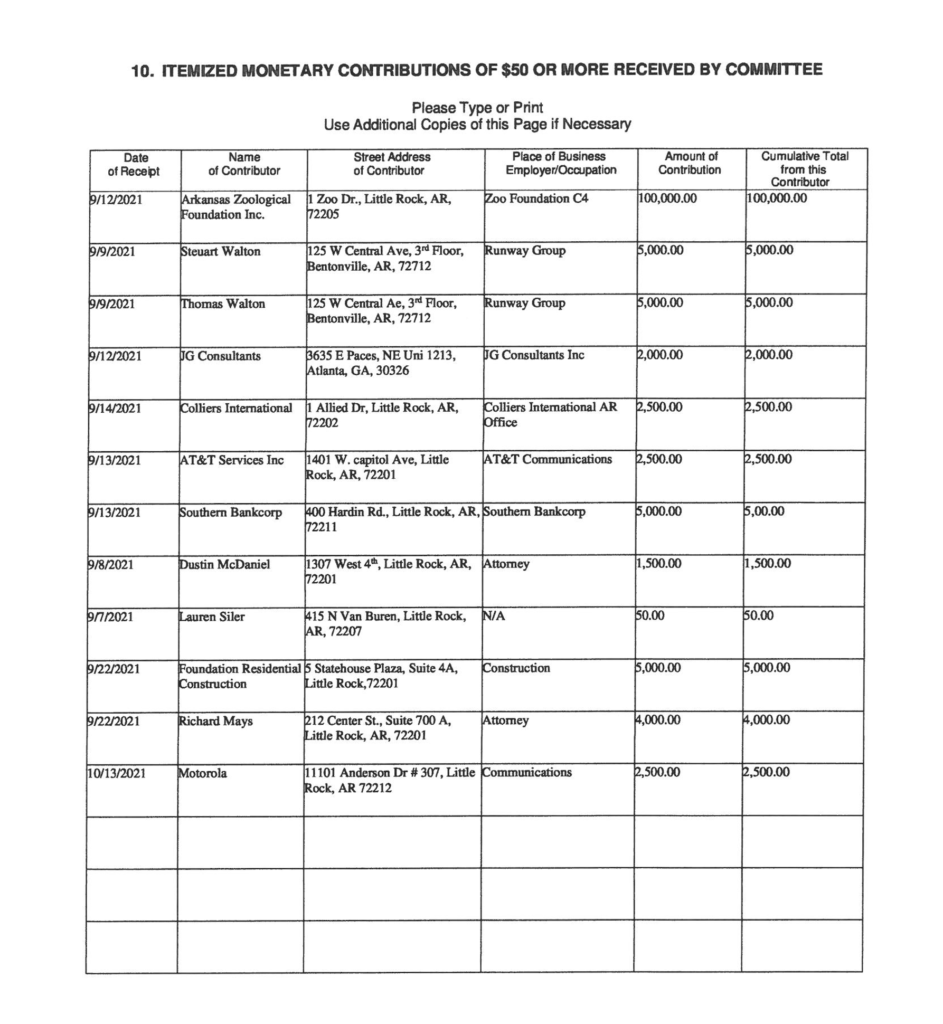

Back to Rebuild the Rock’s fundraising, though. As mentioned above, they raised a total of $346,150 to pilot that Hindenburg. Yet, if you’d looked at their (admittedly terrible) financial disclosures on September 7, seven days before the election, you’d have seen that they raised only $211,100. Why is there a $135,050 difference between those two totals? Glad you asked.

It seems that the Arkansas Zoological Foundation, which had already donated $25,000 to Rebuild the Rock’s efforts on August 12, gave the LQC another $100,000 on September 12.

Reports were that the zoo stood to get $5 million per year if the sales tax passed, so it is perhaps unsurprising that they gave heavily to the cause. But why would they give that much money two days before the election? What was that donation supposed to accomplish in two days? Stated differently, if they were willing to put up $125,000 (roughly 1/3 of the total amount raised) to help pass the sales-tax measure, why not make that contribution months earlier, when the contribution could have actually been used for various voter-outreach measures?

Or, perhaps a more pointed question: why wait until after the last reporting deadline to donate $100,000 of the $125,000 that you were willing to donate? Because, just spitballin’ here, but it sure smells like the point was to donate the money in a way that would not be reported until after the election. And that’s not a good look no matter how much money the zoo stood to gain if the measure passed.