Last week, I wrote about Sen. Tom Cotton (R-Little Rock (?)) and his apparent purchase of an apartment in Little Rock through an entity called Pine & Birch Revocable Trust. I noted in the intro that the post contained a lot of information that, as a whole, did not seem to make sense, but was still interesting enough to write about and see if anyone else had some thoughts or insight.

Well, a side-effect of finding a bunch of information that is interesting but does not fit together in a neat package is that I am incapable of letting it go, even after writing a post, and I tend to obsess over the whole thing and continue to poke around, trying to make everything make sense somehow. To that end, I have spent much of the last week digging into Cotton’s new apartment, its purchase, and anything else that popped up as I dug.

Now, friends, I would love to tell you that I found something that brought the whole story to a tidy conclusion. But that would be a lie. Instead, the more I dug, the stranger everything got.

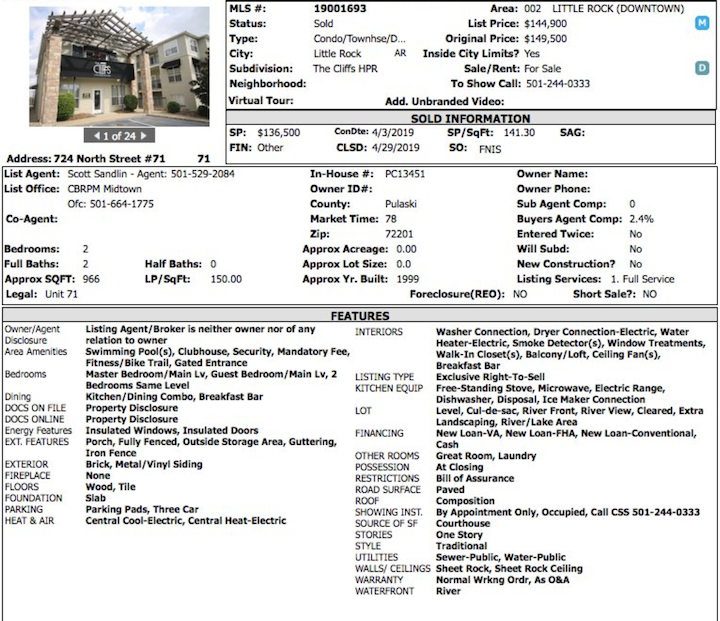

First, when I pulled the property tax records for the new apartment, I saw this:

The taxes on Tom Cotton’s alleged residence, owned by Pine & Birch Revocable Trust, was paid by something called Lighthouse Group Inc., which used the same P.O. Box as the trust. But, while there is a The Lighthouse Group, LLC–albeit with a different listed address–the Arkansas Secretary of State has no “Lighthouse Group Inc.” registered in this state.

Edward “Ted” Dickey is, of course, the same person who is the trustee for the Pine & Birch Revocable Trust. But the address listed for The Lighthouse Group, LLC, on the Secretary of State’s Records? According to Pulaski County property records, Dickey sold that house in 2013. Meaning…there are at least two questions here: (1) Why did The Lighthouse Group (whether LLC or Inc.) pay the property taxes for the Pine & Birch Revocable Trust, rather than the trust paying its own taxes directly (or even Ted Dickey paying personally as trustee)? (2) Why did Lighthouse/Dickey pay the taxes for the trust from an LLC that has had the wrong address for its registered agent for over seven years?

But then it got weirder.

The listing information showed that the buyer’s agent received a 2.4% commission for the purchase of the Little Rock apartment.1

However, if you look at who the buyer’s agent is, you see this:

Sam Ficarrotta is not a licensed real estate agent in Arkansas. The addresses shown come back as a non-existent street address in Lenexa, KS, and the Cooperative Arkansas MLS service in Little Rock. Some Google searching suggests that Mr. Ficarrotta is a customer service manager at Black Knight Financial Services in Kansas. Black Knight does loan origination and loan servicing, so their involvement overall makes sense. But they are certainly not the buyer’s agent.

So who got the 2.4% commission from the sale? I have no idea. It does strike me as weird that Ted Dickey, who is a licensed real estate agent, would not have been the buyer’s agent in this particular scenario, if that is in fact the case. But since this record is a dead-end, the only people who could answer this question would be Ted Dickey, Tom Cotton (maybe), and Scott Baltz (the seller of the apartment).

I should be clear that I do not think that there is necessarily anything untoward going on with the missing buyer’s agent information. It is entirely possible that it was just mis-entered by someone. That said, given all of the other weird aspects of this purchase, and the fact that three Arkansas realtors who I spoke to said they had never seen that in the buyer’s agent information screen, it is still…odd, I guess.

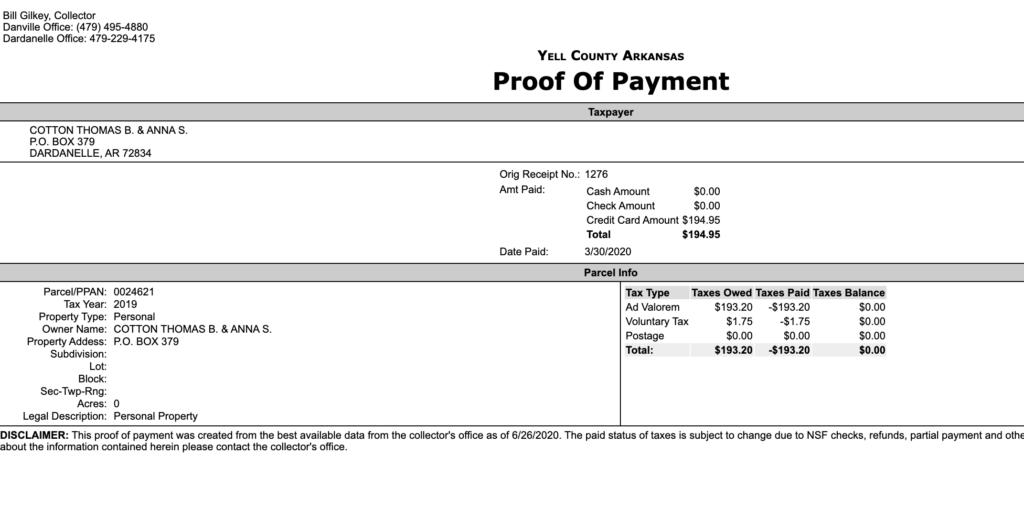

Then there is this. Based on the voter registration cards and the property purchase, Tom Cotton claims to have moved to Little Rock some time between April and June of 2019. Yet, in March 2020, he paid his personal property tax in Yell County using his campaign P.O. Box as the address. Why?

By law, the assessment deadline is May 31 of each year, and you pay your 2020 bill (for example) based on where you assessed in 2019. So, the only way Cotton’s tax bill/payment makes sense is if he bought the Little Rock apartment in April 2019 (which we’ve established via property records), but did not move to Little Rock until after May 31, 2019. That would have made them Yell County residents for personal property purposes for 2019 (as paid in 2020).

But even if that is the situation, and the apartment sat unoccupied by the Cottons until some time in June 2019, Cotton would have been expected to assess his personal property in Pulaski County this year by May 31. Except, according to an email response from the Pulaski County Assessor’s Office, they “have no assessment for Thomas B. Cotton and/or Anna Cotton and no assessment by anyone at 724 North St. Apt 71 in Little Rock.” Because, at this point, of course they don’t; that would make too much sense for this story if they had an assessment from him.

At the end of the prior post about Cotton and his Little Rock apartment, I listed a number of questions that ended with, “why is he just so relentlessly, mind-blowingly weird about absolutely everything?” A week of further digging later, that is what I keep asking myself about Thomas Cotton more than any other question.

Quick aside: The buyer’s agent–also knowing as the selling agent–is the person who shows the property to the buyer; the seller’s agent–also known as the listing agent–is the person who the seller lists the property with when putting it up for sale.↩