The thing about a special election–especially one that only raises a local issue–is that there are not nearly as many financial-disclosure reports required as you would see from, say, a group that was supporting or opposing a constitutional amendment in a regularly scheduled, statewide election. In the most recent special election in Pulaski County, for instance, both the group supporting the proposed tax increase and the group opposing it only had to file two financial disclosure reports each–one on August 16 and one on September 7.

That being the case, you might assume that it would be pretty hard for a group to screw up their financial reporting to a noticeably extent. You would almost certainly assume that it would be impossible to have dozens and dozens of errors in such a small number of filings.

Sadly, you would be wrong; led by Rebuild the Rock’s 60+ errors and/or omissions on their reports, the two groups combined for roughly 90 improper or incomplete entries in their four combined reports.

It was some of the worst attempts at financial-disclosure filings that I’ve seen in quite some time. Worse still, the overwhelming majority of these were errors that anyone who has even passing familiarity with the reporting requirements should never make. They are certainly not the kind of errors that should be made by a paid campaign consultant. Not by a long shot.

Let me back up a bit and provide some context. Both Rebuild the Rock and Responsible Taxation are Legislative Question Committees under Arkansas law. For any contribution received in excess of $50 (individually or aggregate) from a donor, LQCs are required to disclose the date the contribution was received, the donor’s name, the donor’s street address, the donor’s employer/place of business, and both the current contribution amount and the aggregate amount contributed by that donor.

If that seems pretty straightforward to you, you’re already doing better than the folks who did the reports for Rebuild the Rock and Responsible Taxation for Little Rock.

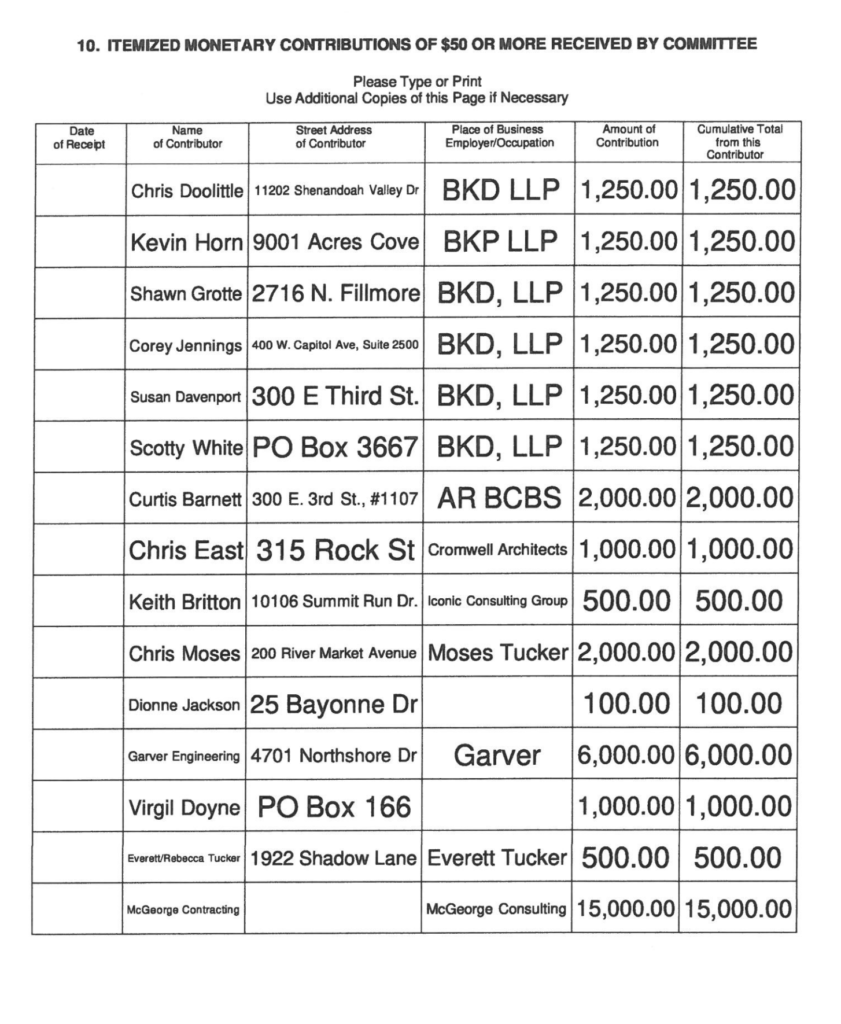

I mean, just look at these pages from Rebuild the Rock’s September 7 report:

How do you not list a date for a single contribution, despite two different subparts of the relevant statute1 specifying that you have to include a date for each contribution? You literally managed to include dates for the contributions in your prior report, but just completely failed to do so here?

How do you just fire this report down range without including street addresses for multiple people and entities?2 Is it that difficult to come up with a street address for Baptist Health or Bernhard Energy? (Googles both.) No. No it’s not?

And, even if we were to give you a pass for not putting “Little Rock” on the addresses for in-town businesses/people, how do you include a North Little Rock company (Garver) and not note in the street address that it is in North Little Rock?

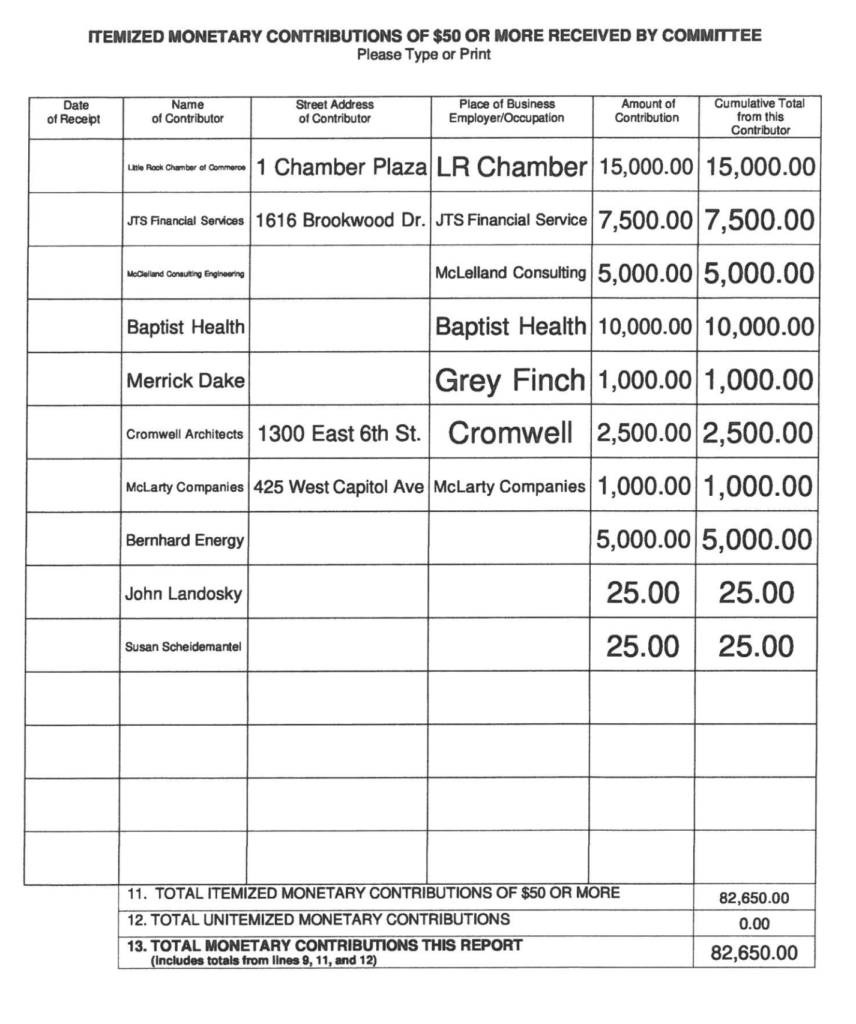

Or look at this page from Responsible Taxation’s August 16 report:

So you’re just going to ignore the “Place of Business Employer/Occupation” field for all but one entry, then include it in the last entry, just so we’re all aware that you did not simply overlook the entire field? Bold strategy.

You can find several additional examples of these kinds of errors in Responsible Taxation’s September 7 report and in Rebuild the Rock’s August 16 report as well. I won’t rehash all of those errors here, since I trust that you can figure out what was omitted even if the committees were not able to do so.

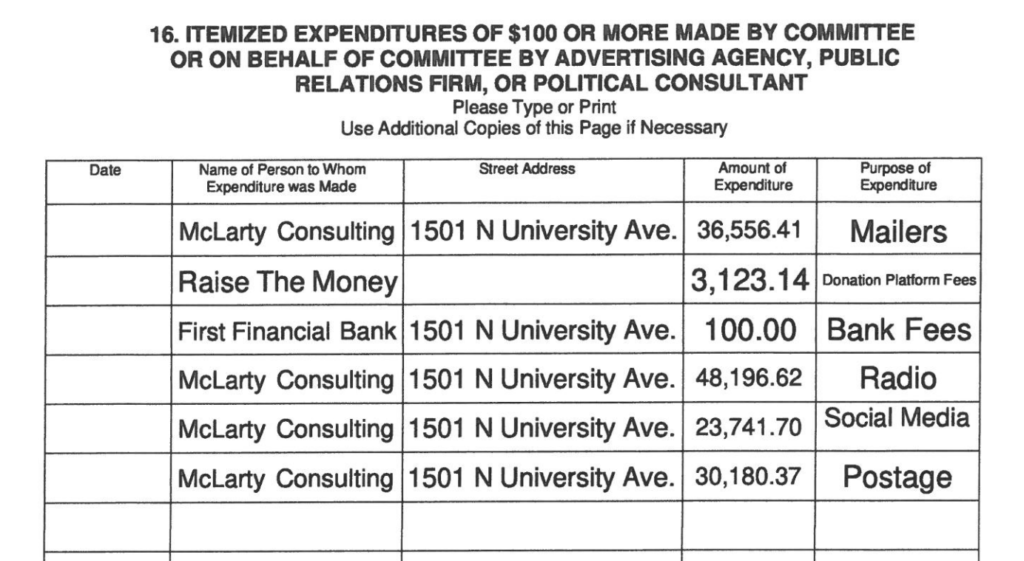

In addition to reporting contributions, LQCs are required to disclose expenditures in excess of $100. This requires simply listing the name and street address of the person or entity to whom the actual expenditure was made and the date of the expenditure. However, under the statute–and thanks to an amendment3 in the law triggered by a 2011 Ethics Commission decision–an LQC cannot just say that they paid X dollars to a consultant for “radio” or whatever. If the consultant was making expenditures on behalf of the LQC, such as by paying for radio or social media or other advertising out of the money paid to the consultant by the LQC–then the LQC is required to disclose the person or company that ultimately received those radio/social media/advertising dollars.

With that in mind, take a gander at Rebuild the Rock’s expenditures in their September 7 report:

Again with a complete lack of dates. Again with a missing street address. And now, on top of those errors, we have $36,556.41 to McLarty Consulting for “Mailers” without any disclosure of who actually designed and printed the mailers or what those mailers actually cost. We have $48,196.62 to McLarty for “Radio” without any specification of which radio stations/companies were actually paid or how much they received. There’s $23,741.70 to McLarty–who, as far as I can tell, is not a social-media company–for “Social Media,” with nary a word about which social-media companies were paid or how much they received.

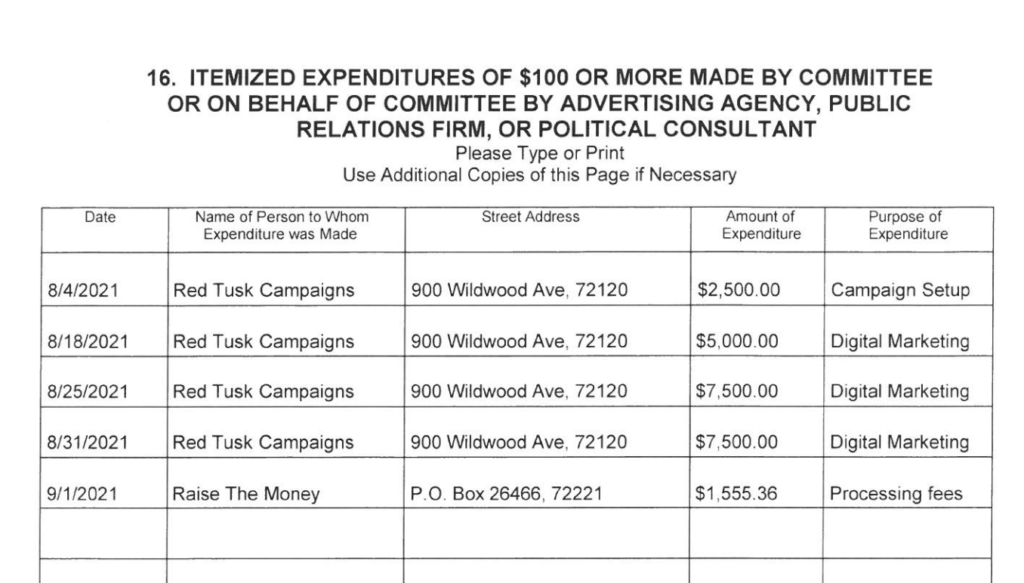

Oh, look. Responsible Taxation did basically the same incorrect job on their expenditure reporting as well, though at least they managed to include dates and street addresses.

I could go on and on here, but I think you get the gist. Both Rebuild the Rock and Responsible Taxation did an absolutely abysmal job of filing financial disclosures. That’s pretty much indisputable. However, if you’re interested in digging deeper into the specifics of all of the errors, you can read about them in these complaints that I filed against both groups with the Arkansas Ethics Commission yesterday afternoon.

As you are no doubt aware by now, the proposed tax increase was defeated rather handily on Tuesday. While I was not in favor of it due to my lack of trust in Mayor Frank Scott based on his multiple lies, I know many readers of this blog were disappointed that the tax failed. Which is why I think it’s worth noting that, even if we look past all the errors in Rebuild the Rock’s disclosures, the content of those filings should give a person serious pause about just who the tax measure was really designed to benefit.

If you look at Rebuild the Rock’s August 16 disclosure, you’ll see that they raised $128,450 in that reporting period. Of that amount:

- $33,500 was from construction companies/executives;

- $25,000 was from the Little Rock Zoo;

- $20,000 was from investment bankers;

- $14,000 was from or on behalf of commercial real estate companies;

- $10,000 was from an engineering/architecture company;

- $5,500 was from consultants;

- $5,000 was from a lobbying firm;

- $2,750 was from accounting/tax companies;

- $2,500 was from a signage company.

Arguably, the only contributions that weren’t obviously self-serving donations from companies/people who stood to potentially benefit in a large way from passage of the tax were $5,000 from Friday, Eldredge, & Clark and $10,000 from Mike Coulson and his wife.

Even stranger, considering how strongly Rebuild the Rock pushed this as a tax that would benefit the city as a whole, the August 16 report does not have a single small donation from some random Little Rock resident. There’s not even a contribution from Frank Scott or anyone in the Little Rock Mayor’s office, despite this being Scott’s pet project! Literally not a single person associated with the mayor’s office gave a dime to this effort. That’s…odd.

The September 7 report isn’t much better, either. That report shows $82,650 raised by Rebuild the Rock over the relevant time period. Of that total:

- $21,500 was from consultants;

- $15,000 was from the Chamber of Commerce;

- $9,500 was from health insurance-related people/entities;

- $7,500 was from employees of an accounting/tax company;

- $11,000 was from engineering firms;

- $3,500 was from architects;

- $2,500 was from realty companies;

- $1,000 was from construction companies.

There’s a $10,000 donation from Baptist Health and $1,050 from folks who don’t seem to have a vested interest in the outcome. Assuming that Baptist didn’t directly stand to benefit from the tax if passed, that’s a whopping $11,050 out of a total $211,100 raised, or 5.2% of the total amount that Rebuild the Rock brought in.

There is still no contribution from Mayor Frank Scott Jr., City Manager Bruce Moore, a single member of the City Board of Directors, or anyone else with actual ties to the management of Little Rock. Not one of them was willing to put any money where their mouths were? Yet…we were supposed to trust that the money would actually be spent just as laid out in the nonbinding plan that was put forward?

I should probably clarify that I am not opposed to tax increases generally. Show me a transparent city government, a binding plan for what the money will be used for, and a tax proposal that isn’t a disproportionate burden on the poor, and I will happily vote for it. But that’s not what this proposed tax was. Not by a long shot. And no amount of “we’ll get a baby giraffe” or don’t you want new baseball fields?!” can gloss over that reality.

I can’t say for sure why the tax failed. After all, some people will just reflexively vote against any proposed tax increase, regardless of what it is. I just can’t help but think that at least part of the reason it failed, however, is because people simply did not trust the mayor and his lackeys to spend the money transparently and in a way that wasn’t blatantly self-serving. In that case, unless you were one of the entities pumping money into this Hindenburg of a campaign in hopes of future paydays, the failure of the proposed tax increase is arguably a good thing.

Ark. Code Ann. 7-9-407(2)(A)↩

Worth noting, “street address” would also not seem to include a PO Box as a valid entry.↩

As amended, the law includes disclosure by the LQC of expenditures made “on behalf of the committee, individual person, or elected official using public funds, by an advertising agency, public relations firm, or political consultant, together with the date and amount of each separate expenditure↩