[Author’s foreward: A little under two weeks ago, I did a series of posts on Representative Mark Martin and his shady, improper, and arguably illegal/unethical actions. See here, here, here, here, and here. Following those posts, however, I realized that I still had questions, especially regarding Martin’s reimbursements for his district office. To answer those questions, I requested and received copies of every invoice for reimbursement that Martin has filed while in state office. I also got copies of Martin’s candidate filing information for each of his four races and copies of his Statement of Financial Interest for each year he was required to file one. Rather than clutter this post with a ton of thumbnails, I have uploaded all of that information to this page. Also, some of the information contained in the following post will be repetitive; my goal with this post is to present one complete picture of Martin’s actions, including what I have learned from the newly acquired information, so that voters realize exactly what a vote for Martin implicitly supports.]

Mark Martin was first elected to the Arkansas House of Representatives to represent District 87 in 2004, and he took his seat on January 10, 2005, for the opening of the 85th General Assembly. He was reelected to that seat in 2006 and again in 2008. On March 4, 2010, Martin filed the required paperwork to become a candidate for Arkansas Secretary of State.

Pursuant to Arkansas Code Annotated § 10-2-212, Martin selected the highest allowable reimbursement level ($800 per month in 2005) and immediately began receiving reimbursements from the State for office expenses incurred in maintaining an office away from the Capitol. Martin has invoiced the state at the highest amount allowable by law at the end of every month from January 2005 to present, he currently receives $1,350 per month ($1,200 for his base reimbursement, plus an additional $150 per month under Arkansas Code Annotated § 10-2-205), and through August 2010 he has received $79,050.

The invoices that Martin presented to the State for the period of January 2005 through December 2007 were from Martin’s company, PsyberSimula, and the invoices for the period of January 2008 to present were from Martin’s corporation, M3 Engineering, Inc. The address for both PsyberSimula and M3 Engineering was listed on every invoice as 123 N. Pittman St., Prairie Grove, AR 72753. Martin is billed in his capacity as State Representative first at 123 N. Pittman St., then at P.O. Box 700, then again at 123 N. Pittman St.

Based on the information contained in these invoices as well as information contained in Martin’s Statements of Financial Interest and Campaign Contribution & Expenditure Reports; the corporate filing for M3 Engineering, Inc.; various online databases; Martin’s Candidate Filing Information for 2004, 2006, 2008, and 2010; and the business license records for Prairie Grove, AR, and Springdale, AR, it appears that Martin has:

(1) violated Arkansas campaign laws by running his campaign(s) out of the district office for which he is reimbursed,

(2) created two business primarily for the purpose of billing the state for reimbursement,

(3) purposefully selected and accepted reimbursements that are grossly disproportionate to his actual expenses,

(4) violated business laws in Prairie Grove and (possibly) Springdale, and

(5) filed incorrect or incomplete Statements of Financial Interest.

We’ll take each of these in order.

II. Martin has run past campaigns and is running his current campaign out of his state-funded office, in violation of Arkansas law.

The campaign practices pledge that each candidate for any office signs and submits when filing to be a candidate includes a statement that the candidate is familiar with certain Arkansas statutes and will follow them throughout his campaign. One of the referenced laws is Arkansas Code Annotated § 7-1-103 (a)(3)(A), which states in pertinent part:

It shall be unlawful for any public servant, as defined in § 21-8-402, to use any office or room furnished at public expense to distribute any letters, circulars, or other campaign materials unless such office or room is regularly used by members of the public for such purposes without regard to political affiliation. It shall further be unlawful for any public servant to use for campaign purposes any item of personal property provided with public funds.

As applied to Martin, there are three prongs to a violation of this statute. First, we must establish that Martin’s businesses are/were based out of his home on 123 N. Pittman St. Second, Martin, in his capacity as a State Representative, must be reimbursed by the State for leasing office space at 123 N. Pittman from Martin’s companies. Finally, Martin must be conducting campaign-related activities at that same address.

N. Pittman from Martin’s companies. Finally, Martin must be conducting campaign-related activities at that same address.

A. M3 Engineering, Inc., and PsyberSimula operated out of 123 N. Pittman St.

With respect to the first prong, when I initially raised this issue, I noted that the invoices for June 2009 through June 2010 as well as the corporate information available from the Secretary of State’s website showed M3 Engineering’s address as 123 N. Pittman St., which is also Mark Martin’s home address. In response, Martin asserted that, despite the evidence I’d mentioned, M3’s office was actually 9310 Wagon Wheel Rd., Springdale, AR.

I countered Martin’s Wagon-Wheel theory by noting that his year-2008 and year-2009 Statements of Financial Interest (SFI), which Martin filled out and filed pursuant to state law, listed M3’s address as 123 N. Pittman, as did Martin’s payment to M3 that he recorded on a Campaign Contribution & Expenditure Report. Furthermore, both the WHOIS registration for Martin’s personal blog, Off The Marble, as well as the M3 Engineering website itself mentioned only 123 N. Pittman as M3’s address and said nothing about any other address.

The newly acquired documents and other information add further credence to the idea that M3 Engineering’s office is located at 123 N. Pittman:

- Every single invoice from M3 Engineering (see this page), from January 2008 to present, lists 123 N. Pittman St. as M3’s address. No mention is made of any alternate office, nor is any invoice from M3 to Martin-as-Representative addressed to 9310 Wagon Wheel Rd., despite Martin’s assertion that the office he sublets from M3 Engineering is at that address.

- Expanding on the two aforementioned references to M3 Engineering in Martin’s year-2008 and year-2009 SFIs, the company’s address is listed as 123 N. Pittman St. three times in each of those filings — under Section 3: Source of Income, Section 4: Business or Holdings, and Section 5: Office or Directorship.

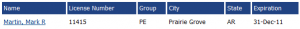

- The website for the Arkansas State Board of Licensure for Professional Engineers lists M3’s address as 123 N. Pittman St.

(click to enlarge)

(click to enlarge)

In addition to M3 Engineering, Inc., the evidence is pretty clear that Martin’s former company, PsyberSimula, in which he still holds a stake worth more than $1,000, conducted/conducts all of its business from 123 N. Pittman St.

- Every single invoice from PsyberSimula (see this page), from January 2005 through December 2007, lists 123 N. Pittman St. as PsyberSimula’s address. No mention is made of any alternate office, nor is any invoice from PsyberSimula to Martin-as-Representative addressed to 9310 Wagon Wheel Rd.

- Every SFI filed by Martin from year-2004 through year-2009 lists PsyberSimula’s address as 123 N. Pittman St.

(PsyberSimula is a somewhat confusing situation. According to Martin’s own website, that company was acquired in 2002 by Renfroe Engineering, Inc. However, PsyberSimula apparently continued to exist as its own non-incorporated entity rather than be subsumed by Renfroe, as evidenced by Martin’s (a) invoicing himself in the name of PsyberSimula and (b) listing of PsyberSimula separate from Renfroe on Martin’s required SFIs. Because the company was never incorporated, it is plausible (if wholly dishonest on his part) to think that Martin continued to do business in the name of PsyberSimula even after that company was “acquired” by Renfroe. More likely, however, is that Renfroe’s acquisition of Martin’s company was overstated or contained certain details and exceptions that allowed Martin to continue using PsyberSimula’s name in endeavors that did not compete with Renfroe’s business interest.)

Of course, as mentioned above, Martin claims that M3 Engineering, Inc., actually conducts business out of the Wagon Wheel address. However, the city of Springdale has no record of any business license for Mark Martin or M3 Engineering within the city limits. Additionally, despite the protestations of exactly one person, every single piece of evidence — most of which contain information provided directly by Martin — points to both M3 and Psyber doing business exclusively out of 123 N. Pittman. Moreover, I note that Martin has not provided me (or Max or anyone else) with documentation supporting the claim that he has been leasing office space at the Wagon Wheel address for “about four years” as he claims.

B. The State reimburses M3 Engineering / PsyberSimula for subleasing office space to Martin at 123 N. Pittman.

Despite Martin’s claim that his district office was subleased from M3 Engineering, Inc., at the Wagon Wheel address in Springdale, the evidence suggests that Martin, via his companies, has been “renting” a portion of Martin’s own home to him for reimbursement purposes. First, we have the fact that Martin’s contact address as listed on the House of Representatives’ website is Pittman St. Secondly, the invoices submitted by Martin from January 2005 through December 2006 (PsyberSimula) and from January 2009 to present (M3 Engineering, Inc.) bill Martin-as-Representative at 123 N. Pittman. The invoices from January 2007 through December 2008 bill Martin at P.O. Box 700, Prairie Grove, AR. No invoice bills him on Wagon Wheel Rd., which would be odd … if one believed that Martin actually had his legislative office for which he must submit invoices for reimbursement at that address.

In short, nothing — literally nothing — suggests that Martin’s district office was located anywhere other than 123 N. Pittman. Sure, there is the one person who claims to have spoken to Martin at the Springdale address, but considering the address in question is home to a Martin campaign donor, you’ll have to forgive me if I let piles of evidence to the contrary trump one person’s personal story.

C. Martin runs his campaign out of the state-funded office.

In my initial post on this issue, I cited a voter’s guide, the use of the 479-466-7386 on the GOP’s candidate-info website and Martin’s own donation link on his website, and and other conflicting use of a second phone number as both a legislative contact and a campaign contact as proof that Martin was campaigning out of his state-funded office. To that, I now add:

- All four of Martin’s candidate information filings reference 123 N. Pittman St. in some way. The 2004 filing lists that address as Martin’s permanent address and lists P.O. Box 700 otherwise. The 2006 filing lists Pittman St. as Martin’s permanent address as the address he listed on his political practice pledge. The 2008 filing uses 123 N. Pittman as Martin’s only address for campaign purposes, using it as permanent address, candidate contact address, and GOP candidate filing form address. The 2010 filing uses the Pittman St. address as Martin’s permanent address and his address for the candidate filing form (that form also used both of the phone numbers listed above as contact numbers for the campaign).

- All of Martin’s Campaign Contribution & Expenditure Reports list 123 N. Pittman as his address, ostensibly for campaign purposes, and all of them also check “no” when asked whether the candidate has a campaign committee with a separate address.

- Any items that do not use 123 N. Pittman St. use P.O. Box 700. However, it goes without saying that Martin is not performing campaign activities such as making phone calls, sending emails, or using a computer or fax machine while at the U.S. Post Office. Thus, he must have some physical office somewhere in which he does actual campaign-related activities. Everything available points to that address as being on Pittman St.

- When registering m3inc.com, “Mark Martin for State Representative” listed its address as 123 N. Pittman.

- The donation — technically improper as it may have been — from Twin Lakes Republican Women PAC went to Mark Martin’s campaign at 123 N. Pittman St.

- The 479-466-7386 number is listed by Martin on his year-2006, year-2008, and year-2009 SFIs; his 2004, 2006, and 2008 Candidate Filing Information; and all of his Campaign Contribution & Expenditure Reports. Problematically, it is also the phone number listed on M3 Engineering’s invoices and is used in various places as the phone number at Martin’s district office. See here.

- The second phone number I mentioned is 479-846-1889, which is the phone number listed as the home landline for 123 N. Pittman St. It is also used by Martin in various places (see here and here; also see Martin’s candidate filing information for 2010 and his SFIs for year-2004, year-2005, and year-2007).

As further proof of Martin’s improper use of state-provided property for campaign purposes, it appears that Martin used his legislative email address as a point-of-contact address on his 2008 candidate filing. This is remarkable, in that, in 2001, the Arkansas Ethics Commission issued a letter of reprimand to Rep. Janet Johnson for using her state computer to send campaign-related emails.

Similarly, it is worth noting that Martin has used P.O. Box 700 for both campaign purposes and as his mailing address for purposes of being invoiced by PsyberSimula for reimbursement by the State. While this alone might not mean much, taken with all of the other evidence, it rounds out the picture of a candidate / lawmaker who has failed to separate his legislative work from his efforts to get reelected.

D. Summary

All reliable evidence (read: all evidence other than one guy’s assertion to the contrary) suggests that Martin’s companies have been based entirely out of his home, that he has accepted reimbursement from the state for letting his companies rent part of his home back to him as a legislative office, and that he is now and has previously run his campaigns out of that same address. In short, Martin has acted in violation of Arkansas Code Annotated § 7-1-103 (a)(3)(A).

III. Both of Martin’s companies, PsyberSimula and (especially) M3 Engineering, seem to exist primarily to bill the State for reimbursement.

When I was looking over the reimbursement invoices submitted by Martin, I noticed something curious. Since January 2009, when Martin switched from his bizarre YYYYMMDD-# invoice number system to a more-common sequential format, nearly every single invoice submitted by M3 Engineering to anyone has gone to the State. Jan 2009 (11) through Dec 2009 (22) and Jan 2010 (29) to August 2010 (36) lack only seven six invoices, all issued some time in early Jan 2010, or they would be perfectly sequential. While the old invoice numbering system was somewhat confusing, it’s worth noting that January 2009 was the 11th full month following the incorporation of M3 Engineering in late February 2008. Regardless of what we can say about invoices submitted under the old numbering system, however, we can say definitively that just under 3/4 of the invoices issued by M3 Engineering since January 2009 are all address to Representative Mark Martin for legislative support services. Other than the  end-of-month invoice sent to Martin, it appears that M3 Engineering literally does no other business, or at least no other business that would require it to invoice a customer. Think about that for a second. Now also consider that Martin’s SFIs show him bringing home more than $12,500 per year from M3 Engineering.

end-of-month invoice sent to Martin, it appears that M3 Engineering literally does no other business, or at least no other business that would require it to invoice a customer. Think about that for a second. Now also consider that Martin’s SFIs show him bringing home more than $12,500 per year from M3 Engineering.

Speaking of Martin’s SFIs, a look at them reveals a curious picture. The year-2004 SFI, covering the year before Martin became a State Representative, lists no income from PsyberSimula (more on that in a bit) and lists the value of Martin’s investment in that company as greater than $1,000 but less than $12,500. The year-2005 SFI gives the same valuation for (and lack of income from) Martin’s stake in PsyberSimula, meaning that the $800/month received over the twelve months of 2005 ($9,600) plus whatever outside business Psyber had in addition to collecting Arkansan’s tax dollars, did not amount to more than $12,500. The year-2006 SFI did list Martin’s investment (including the $9,600 from the State) as greater than $12,500. The year-2007 SFI, covering the time period when Martin received $900 for two months and $1,350 for 10 months (total: $15,300), also valued Martin’s PsyberSimula holdings at greater than $12,500, though, like the other SFIs to this point, did not account for any personal income from this holding.

The year-2008 SFI, covering 12 months of $1,350/month, values Martin’s M3 holdings as greater than $12,500 and Martin’s income from M3 as greater than $12,500, but shows no income from PsyberSimula and values Martin’s Psyber holdings as greater than $1,000 but less than $12,500. Finally, the year-2009 SFI lists the same information as the year-2008 SFI.

Not counting any reimbursements received in 2010, Martin has accepted $66,900 from the State to reimburse him for expenses owed to Martin’s own home-based businesses for rental of some portion of his own home. In only one of the years between 2005 and 2009 where the value of Martin’s reimbursements was not itself greater than $12,500 did the value of Martin’s holding in one of the businesses amount to greater than $12,500. Conversely, despite receiving nearly $10,000 in reimbursements in 2005, Martin listed the value of his holding in PsyberSimula as less than $12,500 that year.

Of course, the invoices from PsyberSimula and M3 Engineering both refer to a “written agreement” between Martin and the companies. However, I struggle to come up with a written agreement, even a month-to-month contract, that would explain this:

- Prior to 2007, Martin received $800/month. Starting January 2007, he began receiving $900/month, with the extra hundred coming under Arkansas Code Annotated § 10-2-205.

- From January 2007 through June 2007, Martin submitted invoices for $900 and was reimbursed that amount by the State.

- In 2007, Arkansas Code Annotated § 10-2-212 was amended, with Martin voting in favor of the amendment, and the highest reimbursement level went from $800/month to $1200/month.

- The amendment took effect in July, but was retroactive to March 2007.

- Martin then went back and collected the extra $400 (plus an extra $50 under § 10-2-205) pursuant to the “written agreement” on his PsyberSimula invoices.

Not to put too fine a point on this, but think about it: if we have a contract agreement for you to lease office space from me for a set amount (say $800/month), which your employer covers, if your employer raises the amount of reimbursement that he is willing to provide, you do not suddenly owe me extra money above our contracted price. That’s kind of the point of a contract, ya know? Yet here, where Martin is leasing his home to himself, he goes back and “reimburses” PsyberSimula an extra $450 simply because he can.

Sadly, Martin’s actions here are technically legal. That does not mean, however, that those actions are not shady and more than a little hypocritical coming from a guy who has been up in arms over his opponent’s acceptance of $650/month as a vehicle allowance.

IV. Martin has purposefully selected the highest reimbursement amount available and happily accepted reimbursements grossly in excess of his own actual expenses.

Under Ark. Code Ann. § 10-2-212 (c), “the maximum amount of reimbursement for legislative expenses incurred by member of the General Assembly shall be, at the option of each member, either … $5,820 per year, … $6,540 per year, or … $14,400 per year.” (emphasis added) Monthly, these figures work out to $485, $545, or $1,200, and the amount any particular lawmaker receives, as noted by the emphasized language in the statute, is entirely up to him or her. (The extra $150/month Martin receives apparently comes from an additional $1800/year he is entitled to under Arkansas Code Annotated § 10-2-205.) For whatever reason, despite the fact that he was “renting” part of his own house to himself, Martin decided to take the highest level.

Just how out of line is that $1,200/month with Martin’s actual expenses? Consider:

- According to Zillow.com, a mortgage on 123 N. Pittman St., Prairie Grove, AR runs about $504/month. Even if we are super generous and suppose that Martin’s mortgage is higher than that — say $600/month — he is still reimbursing himself double the mortgage on the entire house as rent for only a portion of the house. (Remember, he could have chosen $485 or $545 month.)

- Also according to Zillow, Martin’s house is 2,066 square feet. Again, assuming our safe $600/month payment, Martin pays the bank just under $.30/sqft/month. If we assume, for the sake of gross overestimation in Martin’s favor, that Martin uses a whopping 1/4 of his house as office space rented to him by M3, the State is paying $2.33/sqft/month.

- For that same $1,200/month price, the State of Arkansas could rent 2,400 sqft of the Riverdale shopping center in Little Rock. (Where, I might add, they could eat Whole Hog’s brisket often enough to make the $1,200 seem like a bargain.)

So what’s the consequence of excess reimbursement? That’s where it gets a little sticky (again) for Martin. You see, when flat-amount reimbursements are given, any amount that does not actually reimburse the legislator for expenses incurred is considered gross income. See Ark. Code Ann. § 26-51-404. Without seeing his tax returns, I cannot say whether Martin paid taxes on any amount above his actual expenses; however, looking at his SFIs with respect to PsyberSimula, he does not even refer to that company as a source of income. Curious.

On the flip side, if Martin pays his home and cell phone bills (since both numbers are at various times given as his legislative office contact number), then any use of those phones for campaign purposes (both numbers are at various times given as campaign contact phones) is in violation of Arkansas Code Annotated § 7-1-103. Extending that thought, if Martin claims that the amount paid by him to M3 Engineering under the written agreement covers only expenses and leaves nothing left over for personal income, then any use of any part of that office for campaign purposes would be against the law.

Even if what he is doing here is legal — an arguable position at best — Martin’s actions reek of a greed, and his assertions that his opponent’s car allowance is in some way questionable is hypocrisy in its purest form. Let he who has not abused the system cast the first accusation.

V. Martin has violated Prairie Grove law and (if he is to be taken at his word) Springdale law as well.

Martin’s bio on his campaign website touts his creation of PsyberSimula, which apparently occurred some time prior to July 2002 (when Martin says it was acquired by Renfroe). From 2005 through December 2007, Martin’s invoices submitted to the State came from PsyberSimula and listed the company’s address as 123 N. Pittman, Prairie Grove, AR. Martin incorporated M3 Engineering in February 2008 (though, oddly, he invoiced the State from “M3 Engineering, Inc.” in January 2008, three weeks or so before he was actually incorporated), and both the documents of incorporation and every invoice from M3 to Martin for reimbursement purpose lists 123 N. Pittman St., Prairie Grove, AR as M3’s address.

The city of Prairie Grove requires that any company doing business within the city limits have a business license. I contacted Prairie Grove to inquire about Martin’s license — after all, he’s been in business at 123 N. Pittman since at least some time in 2004 by his own admission. In reply, I was informed that Prairie Grove didn’t “have any record of a business license at that location and no record of a business being at that location.”

Martin wants us to believe, despite all the evidence to the contrary, that his business office is in Springdale. Assuming for a minute that he is not lying in order to try to cover his tracks at this late date, it’s important to note that Springdale also requires a business license. When I contacted the city clerk’s office to ask about Mark Martin and/or M3 Engineering, Inc., I learned that neither name was listed in the city’s database. Thus, even if we play along with Martin’s story, he is still violating the law and has been for, as he put it, at least “four years.”

VI. Conclusion

I do not pretend for a second that Mark Martin is the only state lawmaker who abuses the system in this way. As long as there is a system that does not require documentation of actual expenses rather than cutting a flat-rate check every month with no verification, the likelihood of someone abusing it remains at or near 100%.

That said, I also do not buy the argument that, because everyone else is doing it, Martin’s actions are somehow ok. First of all, I doubt that “everyone” is so brazen as to rent part of their house to themselves and then also run their campaign out of that same space. Secondly, of the everyone who does it, Martin is the only one who is running for a statewide office in which he will have minimal oversight. He is also the only one of that group who is running for statewide office and who is attempting at every turn to paint his opponent as unethical and untrustworthy; the irony of this should not be lost on any of you. Finally, and most importantly, even if everyone is taking advantage of the reimbursement system, that does not excuse Martin’s violation(s) of various city requirements regarding business licensing, nor does it mean that people should not be angry about Martin’s attempt to dodge the bullet here by pointing to a Springdale address when every single action he has taken with respect to the businesses lists Prairie Grove.

I have little doubt that some will chalk all of this up to my trying to create controversy. That’s not accurate. I am trying to paint a clear, straight-forward picture of what Mark Martin has been doing for the last six years, and I am asking voters to question whether they want to put someone who has done all of this shady activity in a statewide office that oversees something as fundamental as elections.